It’s been awhile since the world had Kimye. Their paths have differed since that era. I’ll save you from the TMZ reasons, but let’s pretend they were investors. Let’s then pretend they also had the exact same average rate of return over time. But, clearly they have ended up in dramatically different places. How could two people average the same rate of return and have such diametrically opposite outcomes?

Sequence of returns risk isn’t an intuitive concept for most investors to understand. Sequence of returns risk does not refer to your average rate of return over time. It is how you arrive at the rate of return.

It matters most when you reach the distribution phase in your life.

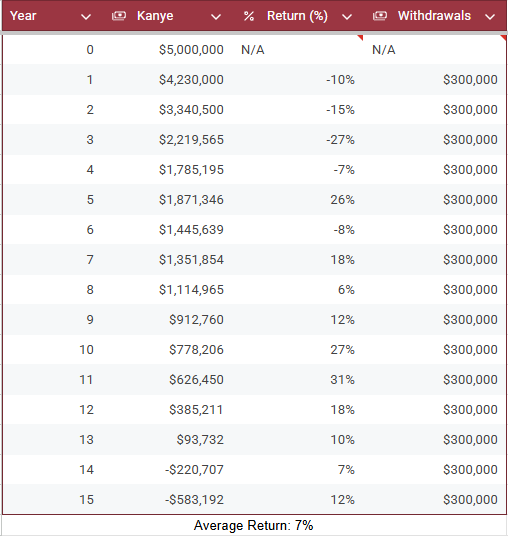

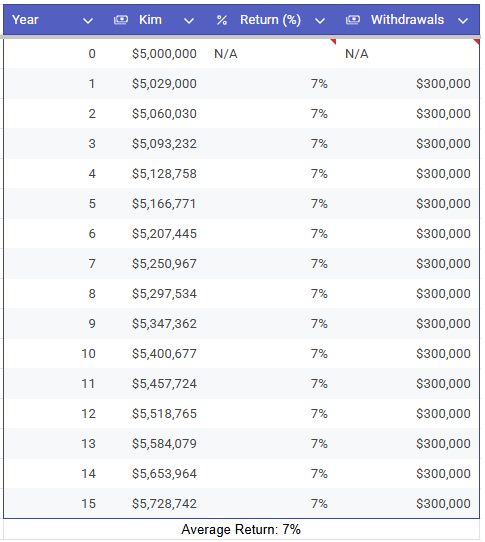

Let’s bring back Kim and Kanye. They each have a portfolio worth $5M. They each withdraw $300K from their portfolio each year. They both average at 7% rate of return over time. Kim, being a little more stable and predictable, achieves exactly a 7% rate of return each year. Kanye, being much more volatile, sees wild swings in his portfolio returns. He’ll go years making and losing double digits with an occasional boring year sprinkled in between.

But after 15 years, Kim has more than she started with and Kanye has been broke for a couple at that point. How could that be? They averaged the same rate of return! It comes down to Kanye’s sequence of returns working against him. To withdraw enough cash for his spending, he had to sell a lot more shares in the early years than Kim. Then, by the time Kanye went on his winning streak he had reduced his share count to a point he couldn’t catch back up before spending it to zero.

If you’re in the accumulation phase of life, this matters very little. When withdrawals are necessary, this matters a lot. Proper considerations in the portfolio can help reduce this risk. It may seem counterintuitive, but a lower risk portfolio can actually increase the likelihood of someone making their money last longer. That is chiefly because the lower risk cash reserves and bond holdings become available for use when the stock market is selling off significantly. We talk a lot about having levers in a portfolio and plan. This is why we want those levers.

-RA