Now that the Republicans and Democrats have officially pledged their delegates to their candidates, the general election season is kicked off. Kamala Harris and Donald Trump are set to square off for the White House. And for my next trick, I’m going to tell you what happens to markets after we find out who wins on November 5th. First, let’s set the stage on a few biases we may have.

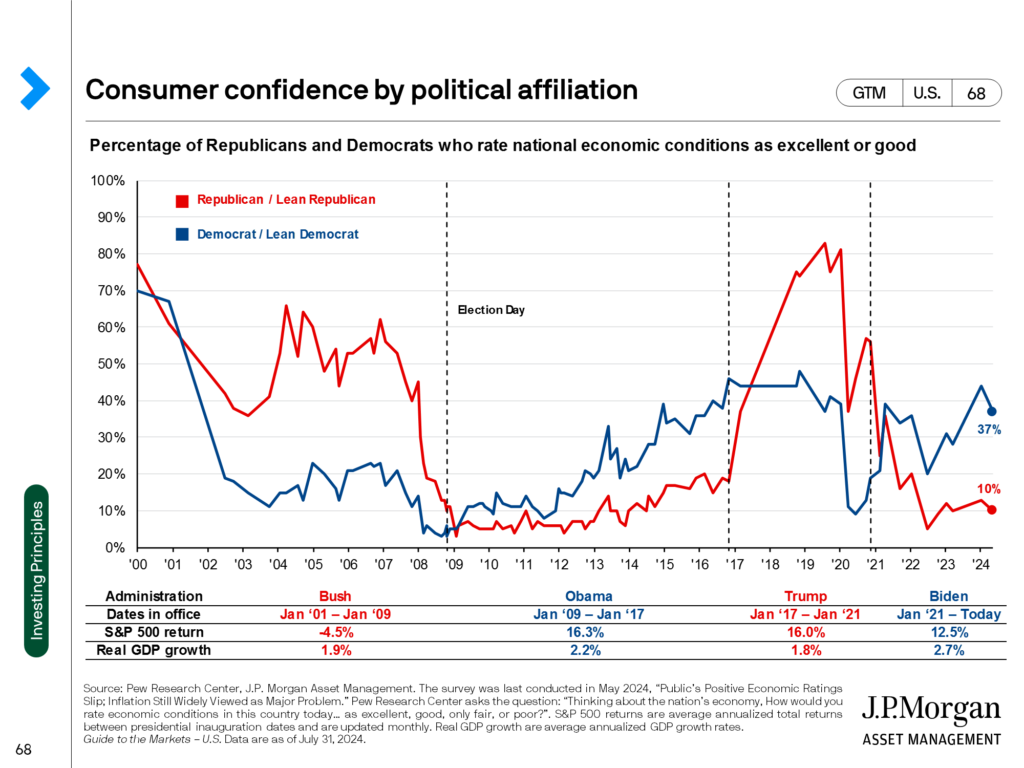

We tend to really like it when our candidate is in the Oval and hate it when they are not. You can probably spot a few bad economies in the chart by JP Morgan below, but our confidence in the economy perfectly flip flops based on the party in office.

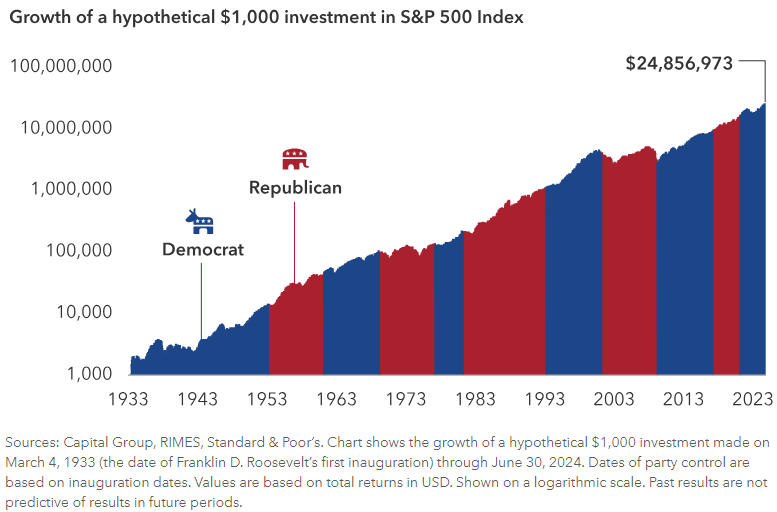

But, certainly one of the two major parties must be better for markets. Right? In the words of Lee Corso, “Not so fast!” There’s really no material difference between the two.

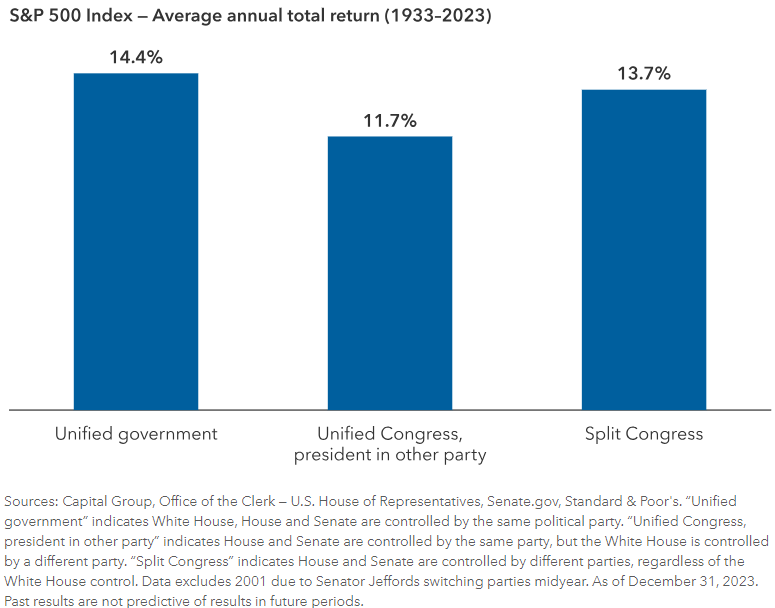

Ok but, but, but what if whoever controls the Presidency also controls Congress too? It may be counterintuitive, but that’s actually the best combination if we look only at market returns. If we were to draw a conclusion, we may say that gives the market the most certainty of what the government will do (or at least try to) over the term. Whereas splits create more uncertainty.

All of that looks pretty investable to me. The “worst” outcomes are still very positive. And that’s due to the American system of checks and balances. Not to diminish the importance of any election, but the system does not allow for one individual to unilaterally make sweeping changes. That’s something we should remind ourselves when we think about what it may mean for our portfolios.

There are certainly many other important issues to consider when casting your vote in November, but don’t vote out of fear for what may happen to your portfolio!