I have a hard time getting into the new rap music that’s out these days. It was just better when I was growing up. It makes me wonder if it actually was better or if I’m just doing like all the old timers do when they say music was better when they were young.

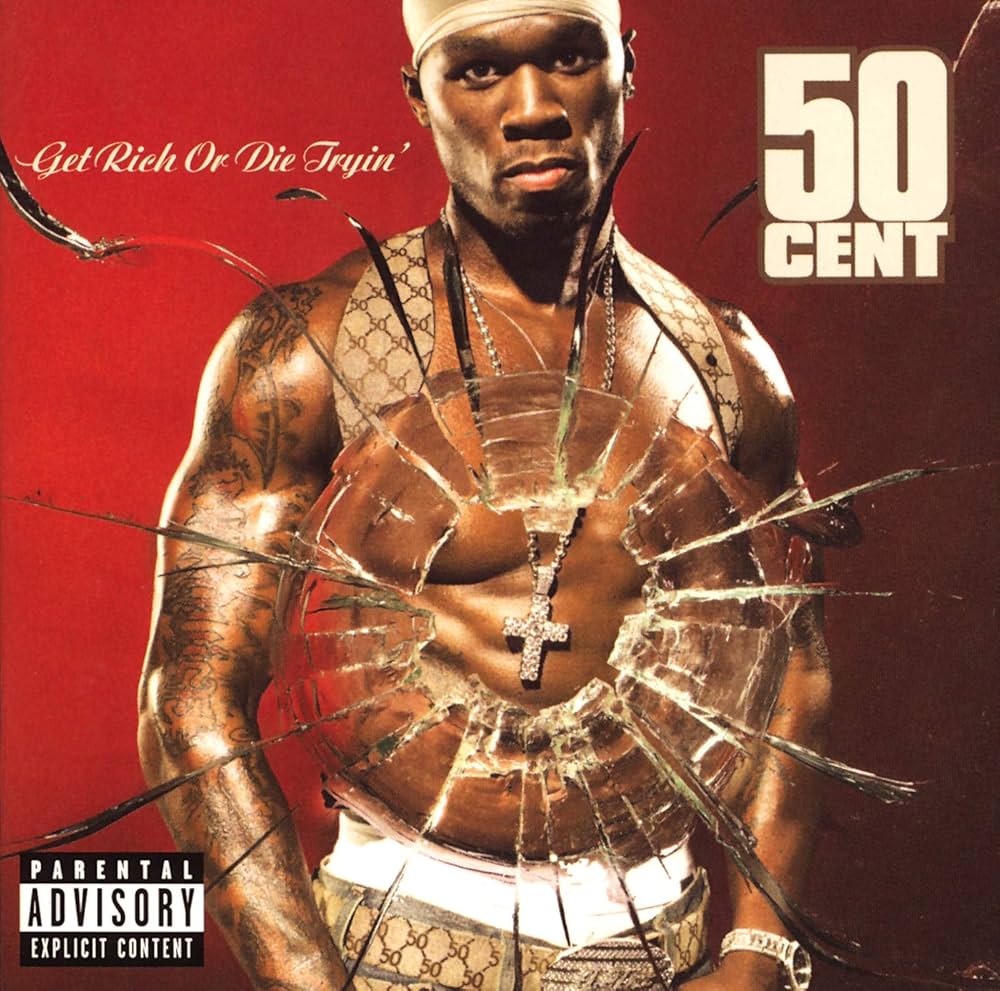

Anyway, one of the best albums of all time is 50 Cent’s “Get Rich or Die Tryin’” and that’s not really up for debate. But, you may not have caught that it’s really a metaphor for the long-term care (LTC) industry. Think about it, you better get rich to cover the expenses or it’s better to die tryin’. Ok, that’s not true in either case.

But, what we do know is the likelihood (according to a 2022 study by HHS) that someone needs any sort of long-term care is 49% for men and 64% for women that reach age 65. Additionally, the average length of care for those that need it is 2.2 years for men and 3.7 years for women. I know you’re already doing some math in your head, but assisted living facilities average about $5350 per month (per Genworth) and nursing facilities average between $8770-$9730 per month depending on shared versus private rooms. That’s typically before the actual long-term CARE is administered. That ranges $65K to $120K annually and can certainly go quite a bit higher. Phew. Factor in a 5% annual inflation rate for healthcare costs, and in 30 years, that range jumps to $280,000 to $518,000. Phew, again.

It’s really a tough spot for most people to plan and prepare for. The ultra wealthy can afford an expense like that, so they may not be too inclined to set aside funds or an insurance policy specifically for it. The middle class and below would probably be very interested in taking that risk off the table because it is so enormous. The problem is long-term care policies can be prohibitively expensive. Another strategy is to use life insurance with a linked benefit that allows the policy death benefit to be accessed for long-term care if someone needs it. Ok, a little more palatable since there’s an asset there. But, still a pretty decent chunk of cash flow coming out to pay the premiums. You get into the tradeoff discussion of fund this, but not that. Balancing the goals of someone’s life becomes a serious discussion of what truly is a top priority and what isn’t.

Health Savings Accounts (HSA) were created in 2003, but were largely inapplicable because most people didn’t have the corresponding high-deductible health care plan (HDHP) that was required to be able to fund one. Enter Barack Obama and the Affordable Healthcare Act. I rarely see someone that isn’t on an HDHP now. Virtually everyone that’s working can now contribute to an HSA. I won’t get into all the benefits of an HSA, but they have tremendous tax benefits now and later.

I’ll have to write about it, but an interesting strategy for those in their peak earnings years is to fund an HSA, but not use the funds until later in life, either through reimbursement of today’s expenses or future expenses as they occur. In either scenario, they are allowing their HSA contributions to appreciate (aka pay for more care). All other things constant, if their investments outperform healthcare inflation, this strategy pays off.

You might be thinking, ok yup that makes sense. I can just save into my HSA and let the funds grow and use the funds out of the HSA to pay for LTC if I need it. You’d be absolutely right and that’s worth considering. However, what you can also do is use the funds to pay for the premiums for a LTC policy, up to a limit.

The current annual LTC premium limits that can be funded by an HSA are:

- 40 and under: $470

- 41-50: $880

- 51-60: $1,760

- 61-70: $4,710

- 71 and older: $5,880

Those aren’t high enough to completely cover the risk of LTC, but they can start to take a chunk of the risk off. If you’re younger and already thinking about this (good for you!), you may not be a good candidate for LTC insurance yet. You are young and/or you have other goals and expenses that you have to allocate towards. But, if those highly beneficial HSA contributions can grow and be used towards partially covering some LTC insurance, we are now really amplifying the benefits.

This strategy allows you to save for LTC and other healthcare expenses, while potentially accumulating a substantial sum in your HSA to offset future LTC insurance costs.

Discuss.

-ryan