Small-caps are outperforming tech by almost 15% in the last two weeks, but Michael Gallup just retired from the NFL at the age of 28. If he were working through his own financial plan, he might assume that he’s just starting a 64 year long retirement.

Michael earned just under $30M on the field. Let’s forget about his endorsements and NFL paid-for healthcare and pension for a moment. The IRS took about half of that in taxes, so those earnings turn into $15M. Now consider he does have to pay something to live, so he’s left with some figure less than that. Is it enough?

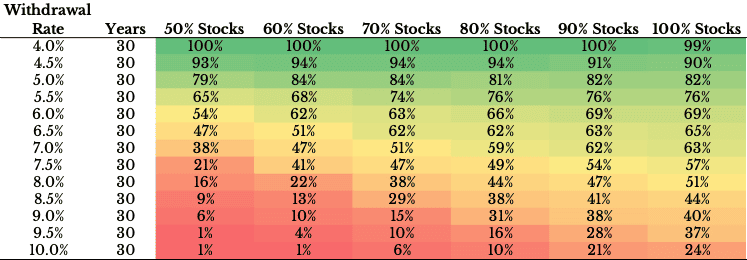

There’s been a lot of chatter lately on the safe withdrawal rate. Nick Maggulli wrote a post about it last year here on his blog Of Dollars and Data. It’s great if you’re into that thing. Most of the analysis is done on a 30 year long retirement and general consensus is withdrawing 4% of your assets at the beginning of your retirement and increasing those withdrawals to keep up with inflation will largely work with a diversified portfolio. But, what if you need to fund a 64 year retirement?! Is that withdrawal rate 3%? 2% 1%?

Let’s say Michael is left with $10M in assets that can be used to fund his 64 year retirement. If he can withdraw 3% of them, then he’s got a $300K lifestyle. At 2% he’s down to $200K. At 1% he’s down to $100K. I don’t know Michael personally, so I don’t know if those budgets would work for the lifestyle he’s accustomed to or not, but what a lot of players in his shoes don’t realize when they retire worth over $10M is they really have to be careful about their spending. There are plenty of cautionary tales of players that didn’t.

Now, Michael was a Dallas Cowboy for awhile so I can only assume that he’s got a lot of sense, plans to still work in another capacity, and will use his NFL career as a launching pad to something bigger.

Congrats to you, Mike, and let me know if you want to play some golf!

-R